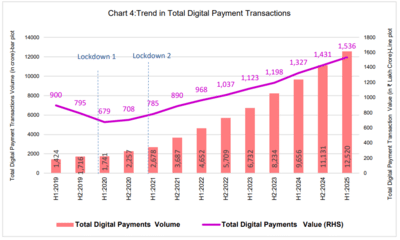

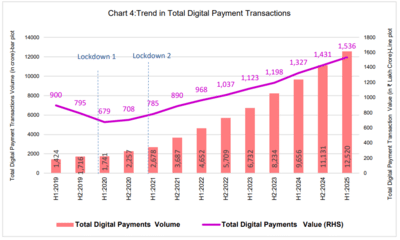

The payments ecosystem in India has witnessed a remarkable growth in recent years with digital payments now accounting for 99.8% of total payment transactions volume in the first six months of 2025. Digital payments now account for 97.7% of the total payment transaction value during the period, as per data released by the Reserve Bank of India ( RBI).

The total payment transactions during the period amounted to Rs 1,572 lakh crore, out of which, Rs 1,536 was transferred as digital payments.

In 2019, digital payments accounted for approximately 96.7% of the total payment transactions by volume and 95.5% by value. However, in 2014, these figures had risen to 99.7% in terms of volume and 97.5% in terms of value.

In the last decade, digital transactions have increased 38 times in volume terms and more than three times in value terms, RBI said in its 'Payment Systems Report'. The CAGR for the decade ending 2024 was 52.5% in terms of volume and 13% in terms of value.

In the last five years, digital payments in India have increased 6.6 times in volume and 1.6 times in value. This amounts to a five-year CAGR of 46% in terms of volume and 10% in terms of value.

The digital payments ecosystem in India comprises of a variety of diverse payment options including credit and debit cards, UPI, IMPS, NEFT, RTGS, digital and mobile wallets, net banking, etc.

The total payment transactions during the period amounted to Rs 1,572 lakh crore, out of which, Rs 1,536 was transferred as digital payments.

In 2019, digital payments accounted for approximately 96.7% of the total payment transactions by volume and 95.5% by value. However, in 2014, these figures had risen to 99.7% in terms of volume and 97.5% in terms of value.

In the last decade, digital transactions have increased 38 times in volume terms and more than three times in value terms, RBI said in its 'Payment Systems Report'. The CAGR for the decade ending 2024 was 52.5% in terms of volume and 13% in terms of value.

In the last five years, digital payments in India have increased 6.6 times in volume and 1.6 times in value. This amounts to a five-year CAGR of 46% in terms of volume and 10% in terms of value.

The digital payments ecosystem in India comprises of a variety of diverse payment options including credit and debit cards, UPI, IMPS, NEFT, RTGS, digital and mobile wallets, net banking, etc.

You may also like

UAE: Abu Dhabi Police return AED 140 million to cyber-fraud victims from more than 15,000 cases over 2 years

Snooker star demands rule change after Neil Robertson wins £500k tournament

'Emily in Paris' to return for season five on December 18

Poached eggs will be 'neat' and delicious if you add one thing to the eggs before cooking

Bhuvan Bam's Busy Schedule: Upcoming Projects and Bollywood Debut